Writ vs Appeal in Tax Litigation: Year-End Strategy for Taxpayers

Writ petition or statutory appeal? Understand key differences, risks, and year-end tax litigation strategy for taxpayers.

Writ petition or statutory appeal? Understand key differences, risks, and year-end tax litigation strategy for taxpayers.

March is never quiet for taxpayers.

Assessment orders start pouring in. Penalty proceedings are initiated. Reassessment notices suddenly appear on the portal. Recovery emails land without warning. And in the middle of all this, taxpayers are expected to make one crucial decision:

Should I file an appeal, or should I move the High Court with a writ petition?

This is where many taxpayers go wrong. Some rush to file an appeal even when the order is plainly illegal. Others file writ petitions that are dismissed in five minutes because an appeal was available.

There is no “one-size-fits-all” answer. The right choice depends on timing, nature of the issue, urgency, and risk.

Taxpayers in Gurgaon and beyond often seek advice from a tax consultant in Gurgaon to understand whether a writ petition or a statutory appeal is appropriate in their situation.

This article explains the real difference between a writ and an appeal, how courts actually look at these matters, and how to plan your year-end tax litigation strategy sensibly.

An appeal is the normal and expected route under tax law. It is a formal challenge to an order passed by a lower authority before a higher appellate authority or court.

In income tax and GST matters, appeals are commonly filed against:

An appeal is basically saying:

“The officer has got this wrong. Please re-examine it.”

An appeal is a statutory right, not a favour. But it comes with conditions:

Miss the timeline or the procedure, and even a strong case can fail. In some situations, taxpayers can also escalate matters further by filing appeals to the High Court under Section 260A of the Income‑tax Act, giving an additional layer of judicial scrutiny.

An appellate court or authority:

In short, appeals are ideal when the dispute is factual, computational, or interpretational.

Must Read: Decoding Gst Interest: Gross Liability Vs. Net Tax Impact

A writ petition is filed directly before a High Court. It is not part of the regular appellate ladder.

A writ is usually filed when the taxpayer says:

“This is not just wrong it is illegal.”

Writ jurisdiction exists to control excesses of authority, not to re-do assessments. This is the essence of High Court writ jurisdiction in tax matters it acts as a check on administrative overreach and protects taxpayers’ fundamental rights.

In tax matters, you will mostly see:

Writs like habeas corpus have no real role in tax litigation.

Know More: Overview Of Tax Litigation In India By Dsrv India

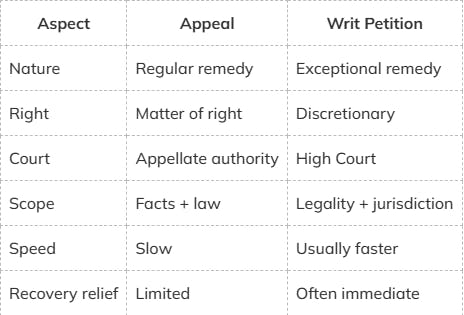

The key difference is this:

An appeal corrects mistakes. A writ corrects illegality.

High Courts repeatedly say:

“If an alternate remedy exists, don’t come to us.”

This is because:

So filing a writ is always a risk-reward decision.

Despite the availability of an appeal, courts do step in in certain situations. Understanding the High Court’s jurisdiction in tax litigation and when writs are entertained helps taxpayers know when direct intervention is possible.

Examples:

These are classic writ cases.

Courts take this seriously:

If the process itself is broken, a writ is justified.

When:

High Courts may intervene directly.

For example:

In such cases, writs are often the only practical remedy.

A writ petition will almost certainly fail if:

Courts will simply say:

“Go and file an appeal.”

Know More: How to handle GST litigation in India - A complete Guide

Interlocutory orders (interim or procedural orders) often cause confusion.

Generally:

Courts interfere sparingly here.

This distinction matters:

If your case depends on documents, explanations, or accounting details appeal is safer.

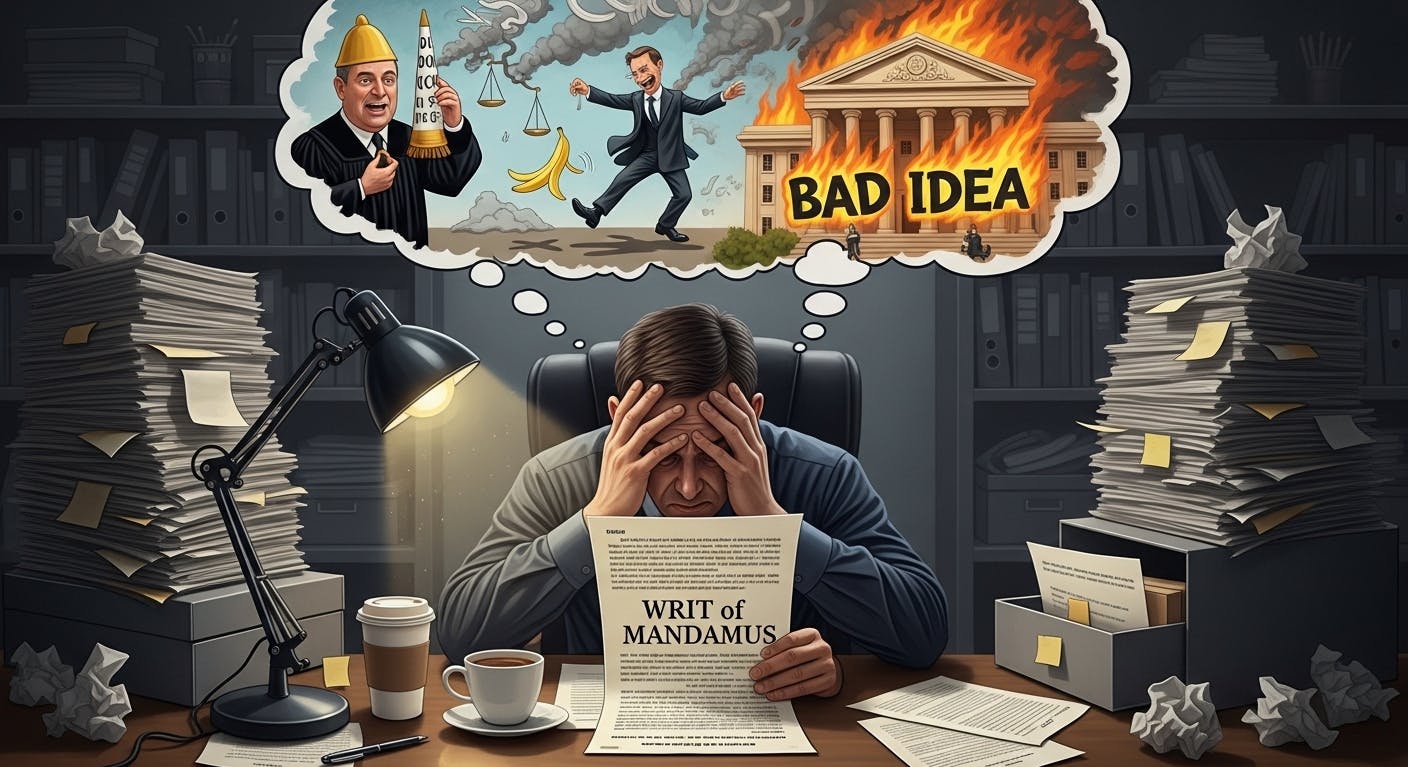

March is not the time to experiment.

Filing a writ only to save time.

Courts don’t appreciate shortcut litigation. If the writ fails, you may also lose the appeal limitation.

That’s a double loss.

Yes, an appeal is technically a petition to a higher forum.

But it is not a constitutional remedy.

This distinction is why courts treat writs differently.

Delay weakens both remedies.

The choice between writ and appeal is not about being aggressive or conservative. It’s about being strategic.

Before rushing to court, pause and ask:

A calm, well-planned decision at year-end can save years of unnecessary litigation. Many taxpayers consult chartered accountant firms in Gurgaon to make the right strategic choice and ensure compliance with all procedural requirements.

Understand GST Section 73 vs 74 of CGST Act. Learn key differences for taxpayers, show cause notice, penalty implications & tax liability. Clarifying 73 & 74!

Writ vs Appeal guide for taxpayers explaining when a writ petition is appropriate when appeal is safer and how to plan writs and appeals at year end.

Understand income tax revision risks under Section 263. Learn about erroneous orders & potential issues under section 263 of the Income-tax Act, 1961.