Revision under Section 263 of Income Tax Act: Key Year-End Risks for Taxpayers

Section 263 revision notices often rise at year-end. Understand when an assessment order is considered erroneous and prejudicial to revenue.

Section 263 revision notices often rise at year-end. Understand when an assessment order is considered erroneous and prejudicial to revenue.

As the financial year comes to a close, many taxpayers believe their income tax assessment is finally settled. However, for a large number of assessees, a fresh risk emerges revision under Section 263 of the Income-tax Act, 1961.

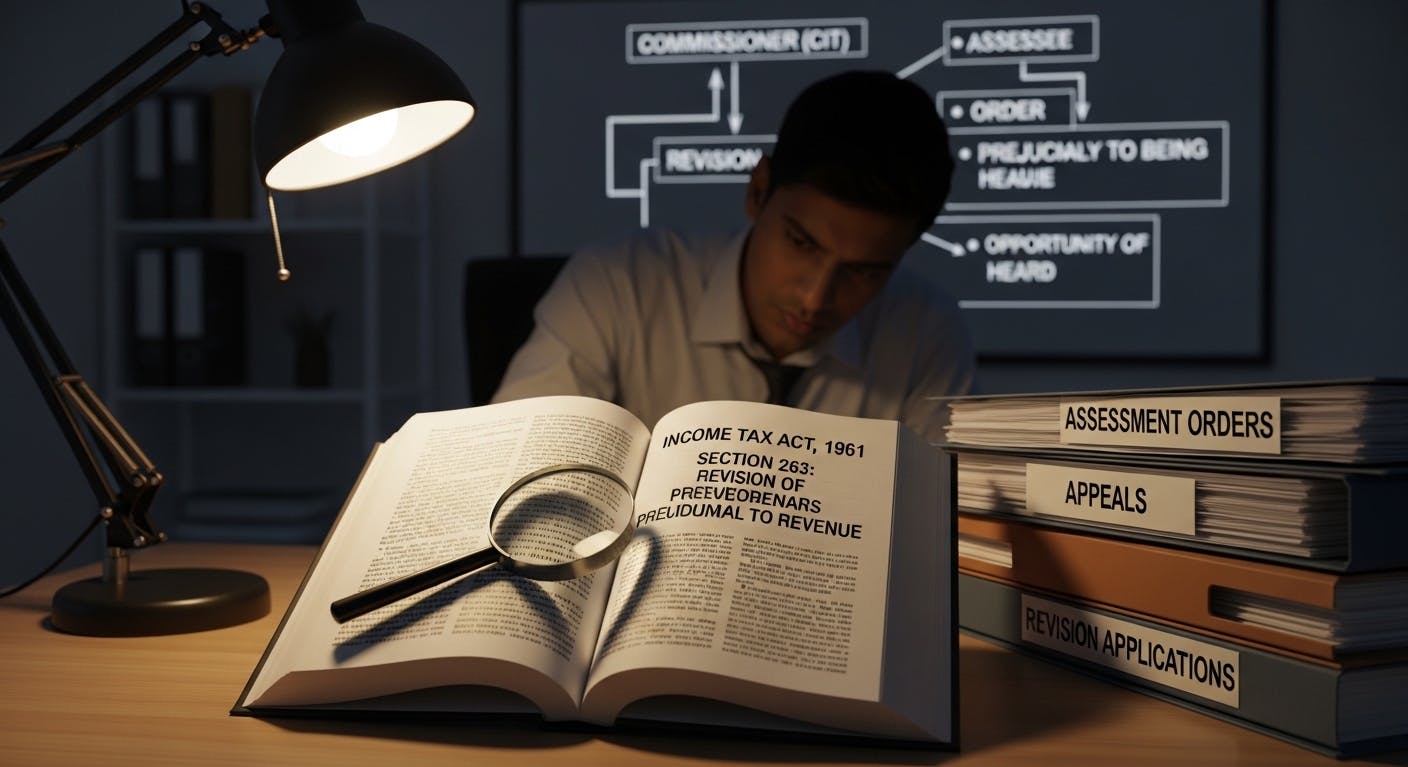

Section 263 empowers the Principal Commissioner or Commissioner of Income Tax (CIT) to revise an assessment order passed by the Assessing Officer (AO) if it is found to be erroneous and prejudicial to the interest of the revenue.

Year-end is a sensitive period because:

These factors often invite revisionary action under Section 263.

For taxpayers seeking professional guidance, consulting a tax consultant in Gurgaon or an income tax consultant Gurgaon can help ensure compliance, assess risk, and prepare safeguards before any revision notice is issued.

This article explains:

Section 263 of the Income-tax Act empowers the Principal Commissioner or Commissioner to revise any order passed by the Assessing Officer if certain conditions are met.

A bare reading of full text of Section 263 of the Income Tax Act shows that:

Both conditions must exist together. If one condition is missing, revision is not permitted.

The power under Section 263 can be exercised by:

The revisionary jurisdiction cannot be exercised by any other income tax authority.

Read more: Special Tips To Handle Assessment Under Income Tax In The Face Less Era

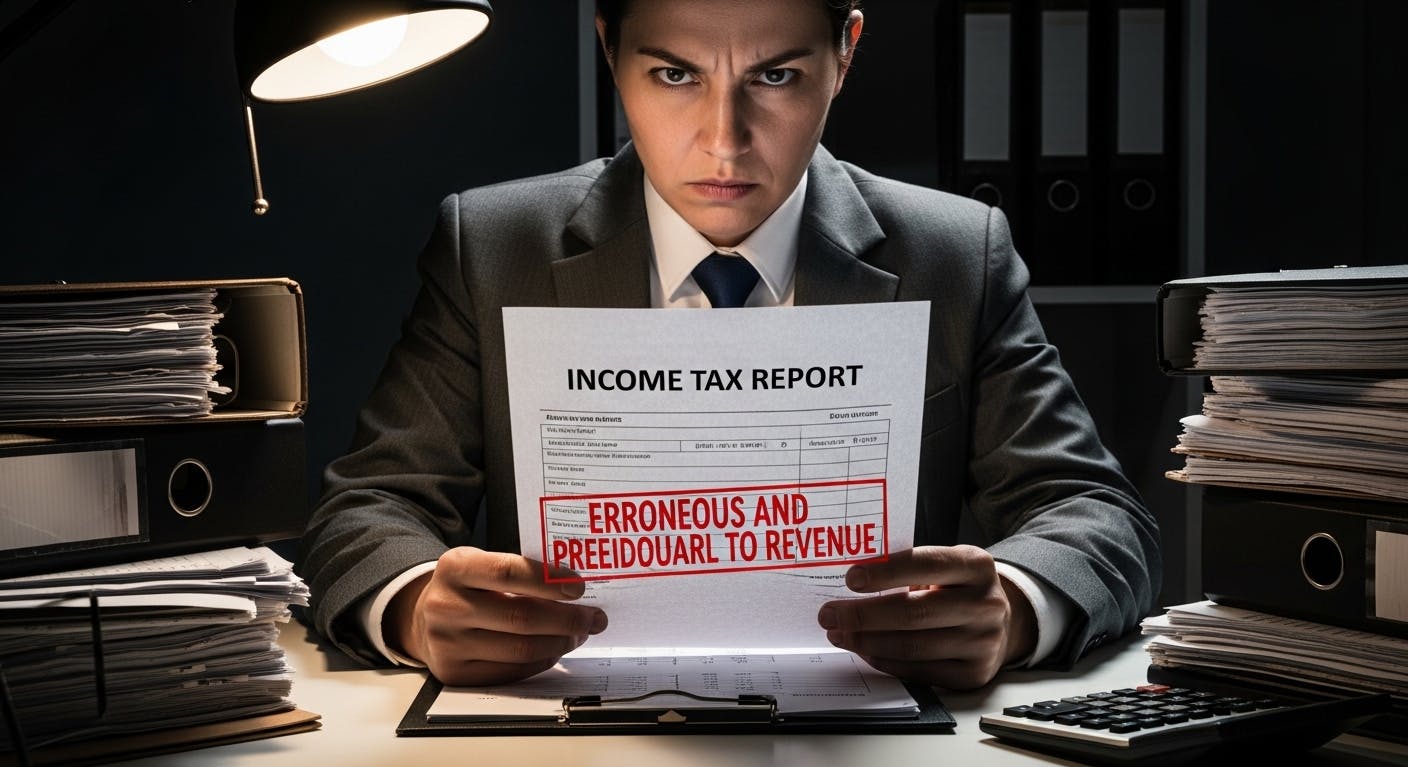

An assessment order is considered erroneous if:

However, merely because the Commissioner has a different opinion does not make the order erroneous.

An order is prejudicial to the interest of the revenue if it results in:

If there is no loss of revenue, revision under Section 263 cannot be sustained.

Section 263 of the Income Tax Act allows the Principal Commissioner or Commissioner to revise an assessment order only when both conditions erroneous and prejudicial are satisfied simultaneously. For the full text of Section 263 of the Income Tax Act, you can refer to the official statute, which clearly defines the scope and limits of revision powers.

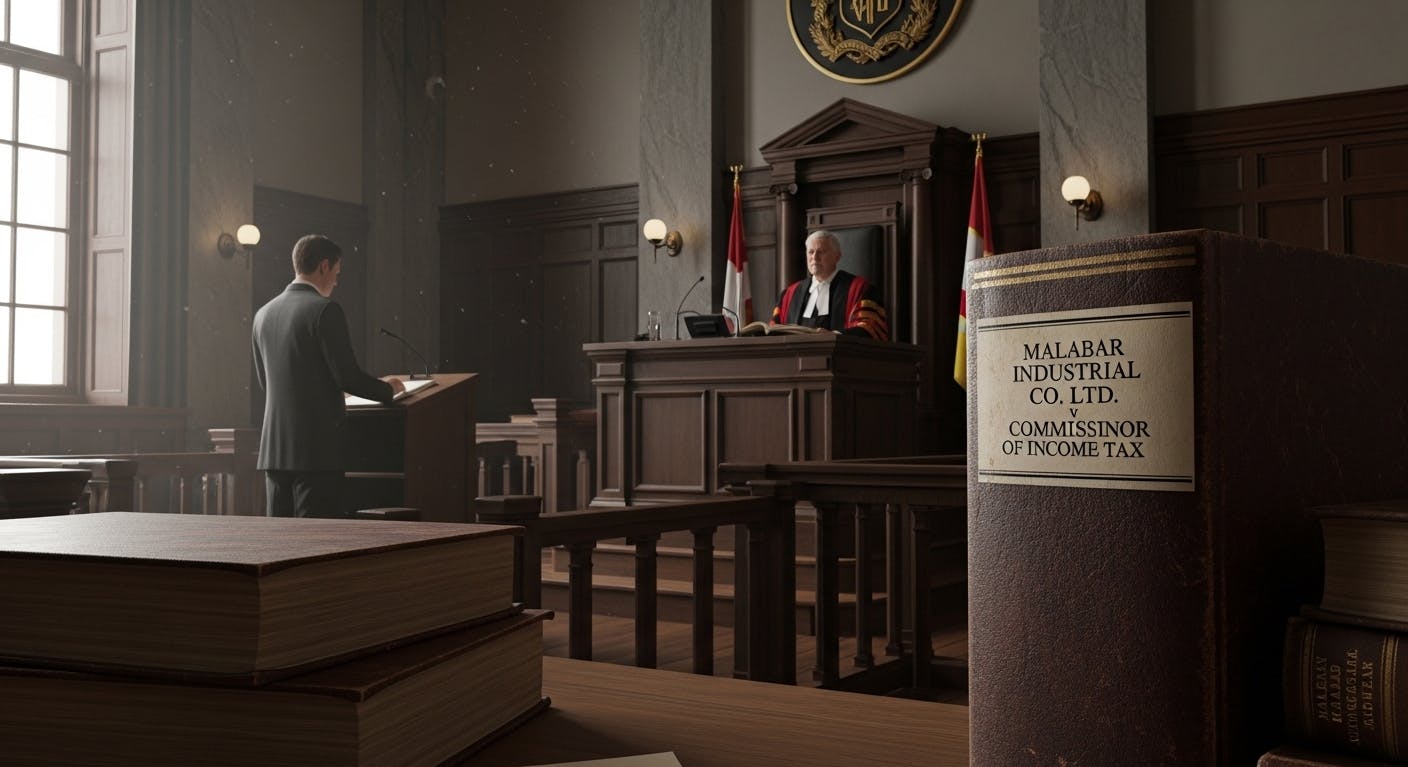

The Court held that:

This judgment continues to guide Section 263 jurisprudence.

At year-end:

The Commissioner later reviews these orders and may conclude that:

This is why Section 263 notices spike after March.

One of the most common grounds for revision is that the assessment order was passed without inquiry or verification.

If the AO:

The order may be deemed erroneous in so far as it is prejudicial to the interest of revenue.

Courts make a clear distinction between:

If some inquiry was conducted, the Commissioner cannot revise the order simply because he believes more inquiry was needed.

Year-end assessments often allow:

If such relief is granted contrary to law, the order may be revised under Section 263.

If the AO applies:

The assessment order becomes unsustainable in law, opening the door to revision.

Under Section 119, the Board issues instructions binding on tax authorities.

If an assessment order is:

It may be deemed erroneous for the purposes of Section 263.

Recommended: Brief Understanding On Income Tax Assessment

Section 263 includes an Explanation that deems certain orders to be erroneous, such as:

These deeming provisions strengthen the Commissioner’s revisionary powers.

For the full text of Section 263 of the Income Tax Act, you can refer to the official statute to understand the scope, limits, and judicial interpretation of this provision.

Before revising an order, the Commissioner must:

Failure to grant a proper hearing makes the revision order invalid.

The Commissioner cannot:

Section 263 empowers revision, not review.

If the AO has:

The order cannot be revised merely because the Commissioner holds a different opinion.

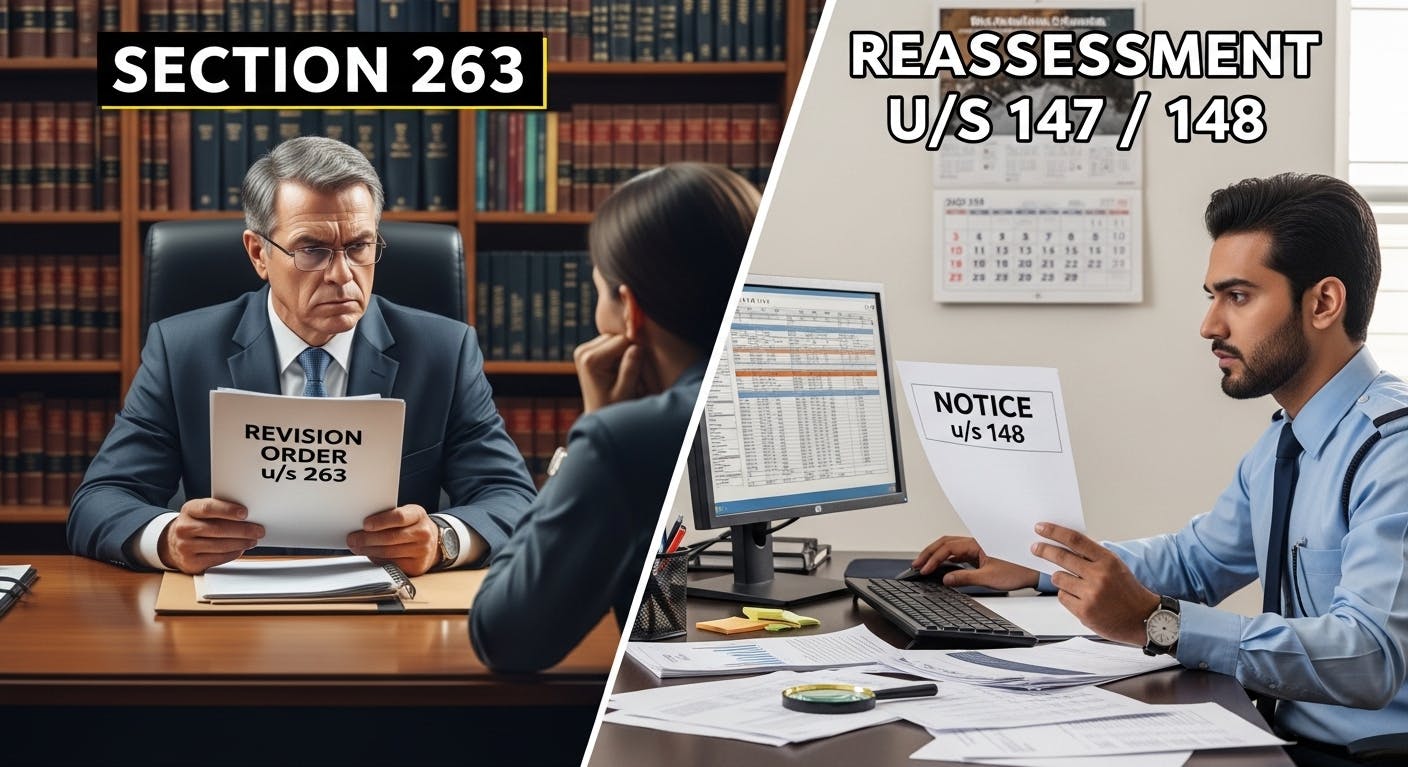

Revision under Section 263 is different from reassessment under Section 147.

Both operate in different fields, and misuse of one to substitute the other is not permitted.

The Commissioner must pass a revision order within two years from the end of the financial year in which the assessment order was passed.

Orders passed beyond limitation are void.

Must read: A Comprehensive Guide For ITR: Income Tax Notice Reply Format

Once an order under Section 263 is passed:

However, the AO cannot go beyond the scope of directions issued.

Revision is not valid when:

Taxpayers can reduce Section 263 risk by:

Strong documentation is the best defence.

If required, the order can be challenged before the Income Tax Appellate Tribunal.

Revision under Section 263 is a powerful tool in the hands of tax administration, but it is not absolute.

For year-end assessments, the risk of revision increases due to time pressure and limited inquiry. However, the law clearly protects taxpayers from arbitrary revision.

Understanding the twin conditions, judicial safeguards, and practical risk areas helps taxpayers defend their assessment orders and avoid unnecessary litigation.

A well-conducted assessment supported by proper inquiry remains the strongest shield against Section 263 action.

For professional support, chartered accountant firms in Gurgaon can help review assessment orders, ensure compliance, and prepare defenses against potential revision under Section 263.

Understand income tax revision risks under Section 263. Learn about erroneous orders & potential issues under section 263 of the Income-tax Act, 1961.

Understand tax penalty proceedings. Learn about assessment under the Income Tax Act, when a penalty can be imposed, and initiation of proceedings.

Understand faceless assessments & appeals under Income Tax Act. Guide to the scheme, taxpayer rights, and handling notices.