Penalty Proceedings Initiated in March 2026: Legal Validity Under Income Tax Act

Penalty proceedings initiated in March 2026 are often challenged due to procedural defects. Learn when penalty is valid and how courts view such cases.

Penalty proceedings initiated in March 2026 are often challenged due to procedural defects. Learn when penalty is valid and how courts view such cases.

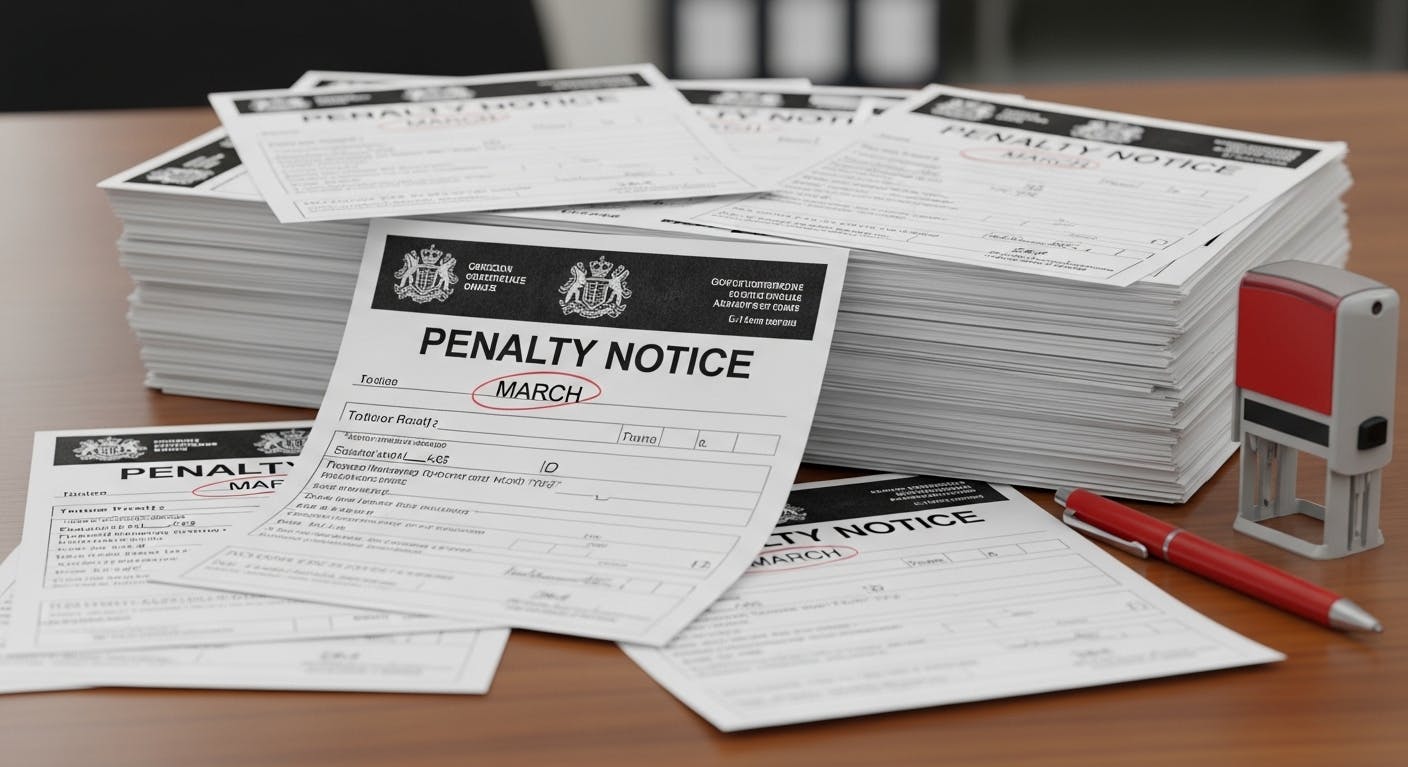

March is a crucial month under the Income Tax Act, 1961. It is the time when assessment proceedings are rushed to completion, and along with assessment orders, penalty proceedings are often initiated mechanically.

Many assessees receive assessment orders stating:

“Penalty proceedings under the relevant section are initiated separately.”

However, the key question is are penalty proceedings initiated in March 2026 always legally valid?

The answer is no.

Courts, including the Supreme Court, High Courts, and the Income Tax Appellate Tribunal, have repeatedly held that penalty is not automatic. It must follow strict legal conditions.

For guidance and to protect your rights, consulting experienced chartered accountant firms in Gurgaon or a trusted income tax consultant in Gurgaon can help ensure penalty proceedings are properly scrutinized and challenged when needed.

This article examines:

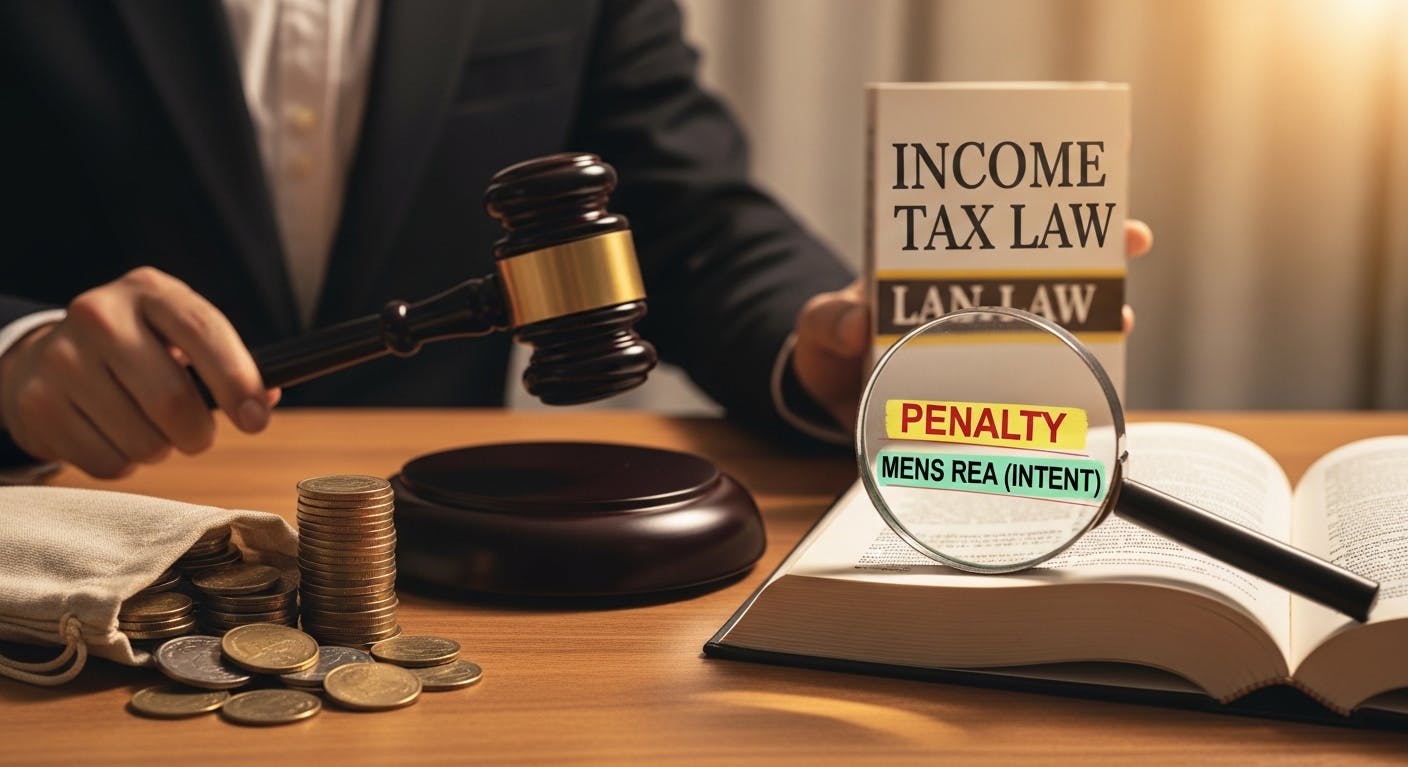

Penalty proceedings are separate proceedings initiated by the Assessing Officer (AO) to impose a monetary penalty on the assessee for specific failures under the Act.

These proceedings may arise due to:

It is important to understand the Income‑Tax penalty provisions and conditions for initiation to know when and how these proceedings can be validly invoked.

A common misconception is that once an addition is made during assessment, penalty must follow. This is incorrect.

The law is clear:

Courts have consistently held that penalty cannot be imposed merely because an addition survives.

March is the last month of the financial year. During this period:

This urgency leads to procedural lapses, which affect the legal validity of penalty initiation.

Read more: A Detailed Guide On How To Be Ready For Income Tax Assessment In India

Under the Income Tax Act, penalty proceedings can be initiated only if the Assessing Officer records satisfaction during the assessment proceedings.

The satisfaction must be:

A vague statement such as “penalty proceedings are initiated” is not sufficient.

In many March 2026 orders, penalty is initiated:

Courts have held that mechanical initiation is invalid in law.

This highlights the importance of understanding the penalty initiation requirements under Section 270A to ensure that penalties are levied lawfully and fairly.

Another common issue is:

If the notice issued under section is defective, the entire penalty proceeding becomes invalid.

Penalty can be imposed only if:

A bona fide claim, even if disallowed, does not attract penalty.

If the issue:

Then penalty cannot be imposed merely because the assessee’s claim was rejected.

This principle has been upheld by the Supreme Court and several High Courts, reinforcing the importance of penalty proceedings and natural justice requirements in income‑tax matters.

In some cases:

Jurisdictional defects go to the root of the matter and cannot be cured later.

If:

Then penalty proceedings automatically fail, as they arise from the assessment.

Recommended: The Ultimate Survival Guide To Income Tax Assessment Are You Prepared?

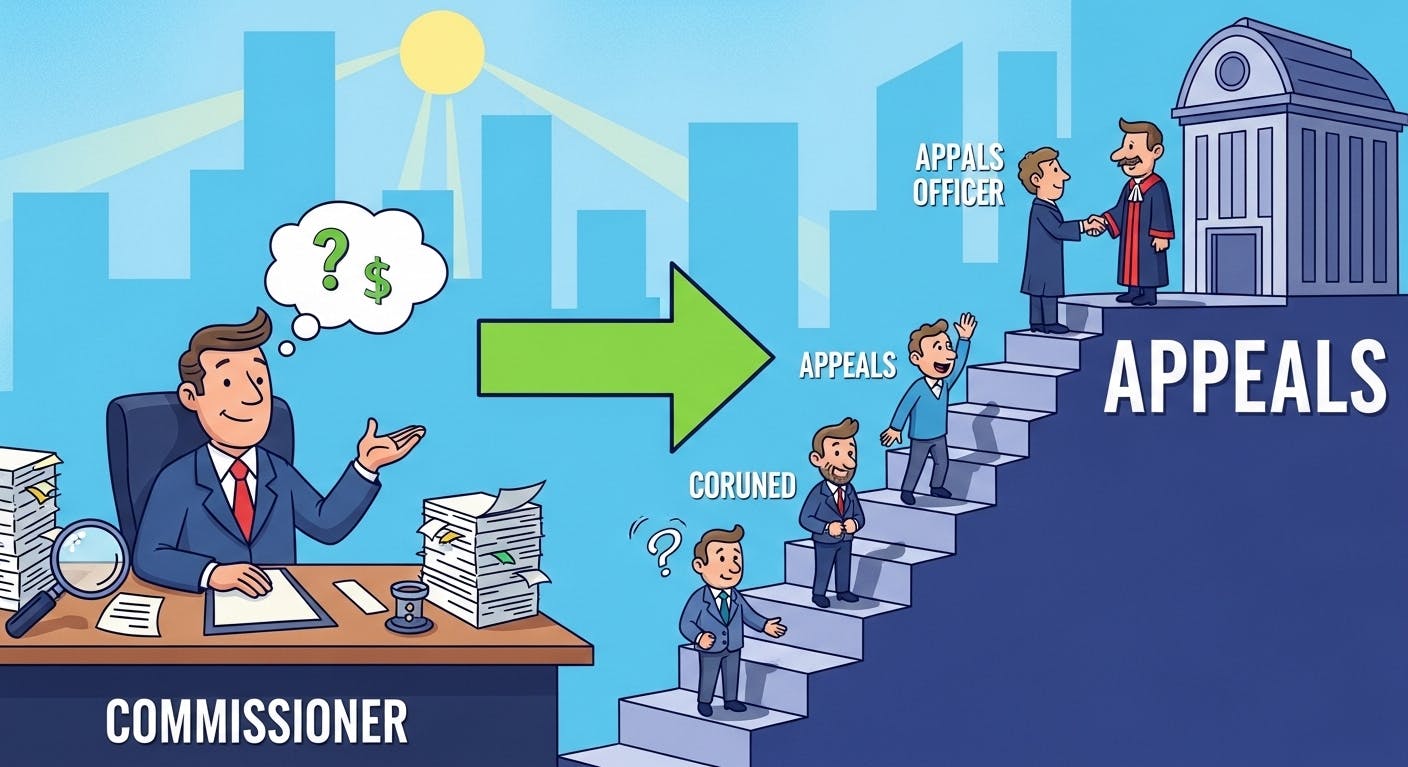

An assessee aggrieved by penalty can file an appeal before:

The appellate authorities have the power to:

While strict liability applies in some penalty provisions, courts still examine:

Penalty is not meant to punish every error or mistake.

Penalty may arise where:

However, where:

Penalty is not justified.

It is also important to be aware of the limitation for initiating and concluding penalty proceedings to ensure that penalties are imposed within the legally prescribed timeframe.

In March 2026, many assessees received:

Courts have repeatedly held that such notices are legally defective.

The Delhi High Court, Bombay High Court, and Supreme Court have consistently ruled that:

Penalty proceedings cannot be sustained on assumptions.

In business cases:

Do not automatically lead to penalty.

Where an accountant’s advice is followed in good faith, penalty is generally not leviable.

In cases of:

Penalty applicability depends on the terms of settlement and statutory provisions.

Penalty cannot be imposed beyond what the law permits.

If penalty proceedings were initiated in March 2026, check:

Know more: How to Check and Authenticate Income Tax Notice on the Official Portal

Timely and well-drafted response makes a significant difference.

Penalty proceedings initiated in March 2026 deserve close scrutiny. Many such proceedings suffer from serious legal defects due to:

Penalty under the Income Tax Act is a serious consequence, not a routine add-on to assessment.

Taxpayers who understand their rights and the law can successfully challenge invalid penalty proceedings and avoid unnecessary tax burden. Consulting a reliable tax consultant in Gurgaon can help navigate these proceedings effectively.

Understand tax penalty proceedings. Learn about assessment under the Income Tax Act, when a penalty can be imposed, and initiation of proceedings.

Understand faceless assessments & appeals under Income Tax Act. Guide to the scheme, taxpayer rights, and handling notices.

GST Limitation Period ends March 31! Close notices & appeals under CGST Act Section 73 & 74. Know the time limit for GST demands, avoid penalties.