GST Limitation Period Explained: Notices, Appeals & Deadlines Before March 31, 2026

Understand GST limitation periods for notices and appeals. Learn which GST matters must be closed before March 31, 2026 and how to protect your rights.

Understand GST limitation periods for notices and appeals. Learn which GST matters must be closed before March 31, 2026 and how to protect your rights.

GST limitation period is one of the most ignored but powerful concepts under GST law. Many taxpayers focus only on replying to notices or filing appeals, but forget to check whether the GST department is even allowed to act at that stage.

As we move closer to March 31, 2026, this date has become extremely important. A large number of GST notices, assessments, and appeal opportunities related to earlier years will expire permanently if not acted upon within the prescribed time.

This guide explains in simple words what the GST limitation period means, how the GST notice period works, the GST appeal timeline, and the time limits for GST notices and orders under GST law, and how taxpayers can legally close old GST disputes using limitation rules. Consulting a reliable GST consultant in Gurgaon can help ensure you don’t miss critical deadlines.

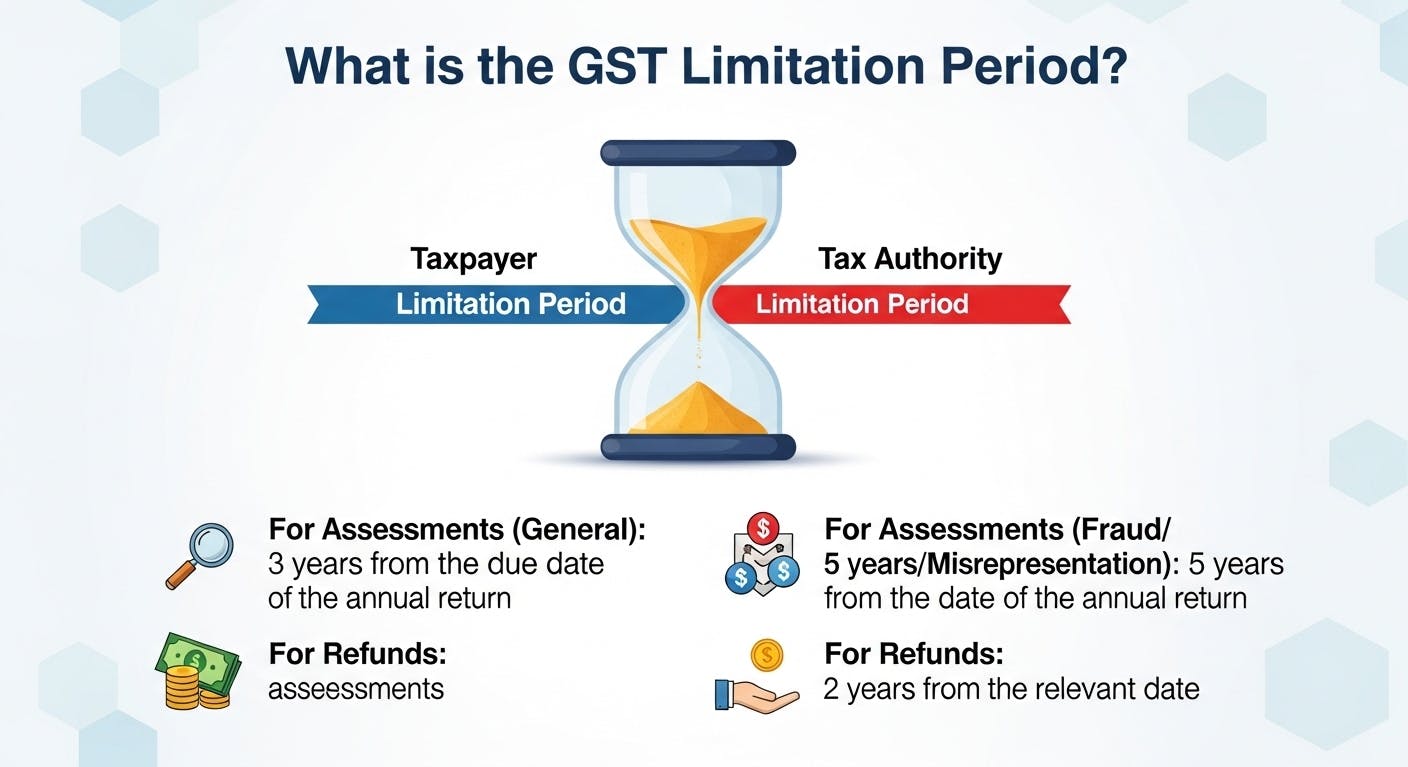

The GST limitation period refers to the maximum time allowed under GST law to take a particular action.

This time limit applies to both sides:

Once this time limit expires, the action becomes legally invalid, unless the law specifically allows an extension.

In simple terms:

If time is over, the right is lost.

March 31, 2026 is important because it marks the outer boundary for many GST matters relating to the initial years of GST, such as:

If GST notices are not issued, or appeals are not filed, before the limitation period ends, those matters may have to be closed permanently.

This makes the year 2025–26 the last opportunity for resolving or challenging many old GST disputes.

Read more: A Complete Guide To Mandatory Documents For GST Registration In 2025

When tax is short paid or ITC is wrongly availed without fraud or suppression, the GST department must follow Section 73.

Time limit:

Example:

For FY 2018–19:

Any notice issued after this period can be challenged as time-barred.

For businesses planning compliance or new registrations, consulting a GST registration in Gurgaon service can help ensure all deadlines and filings are properly managed.

If the department alleges fraud, wilful misstatement, or suppression of facts, Section 74 applies.

Time limit:

However, courts have clearly stated that:

Simply calling a case “fraud” does not automatically extend limitation.

This explanation aligns with the CGST Act Sections 73, 74 & 74A limitation framework, helping taxpayers understand their rights and the legal time limits for GST notices and orders.

Read more: Key Considerations For The GST Registration For Startups In India

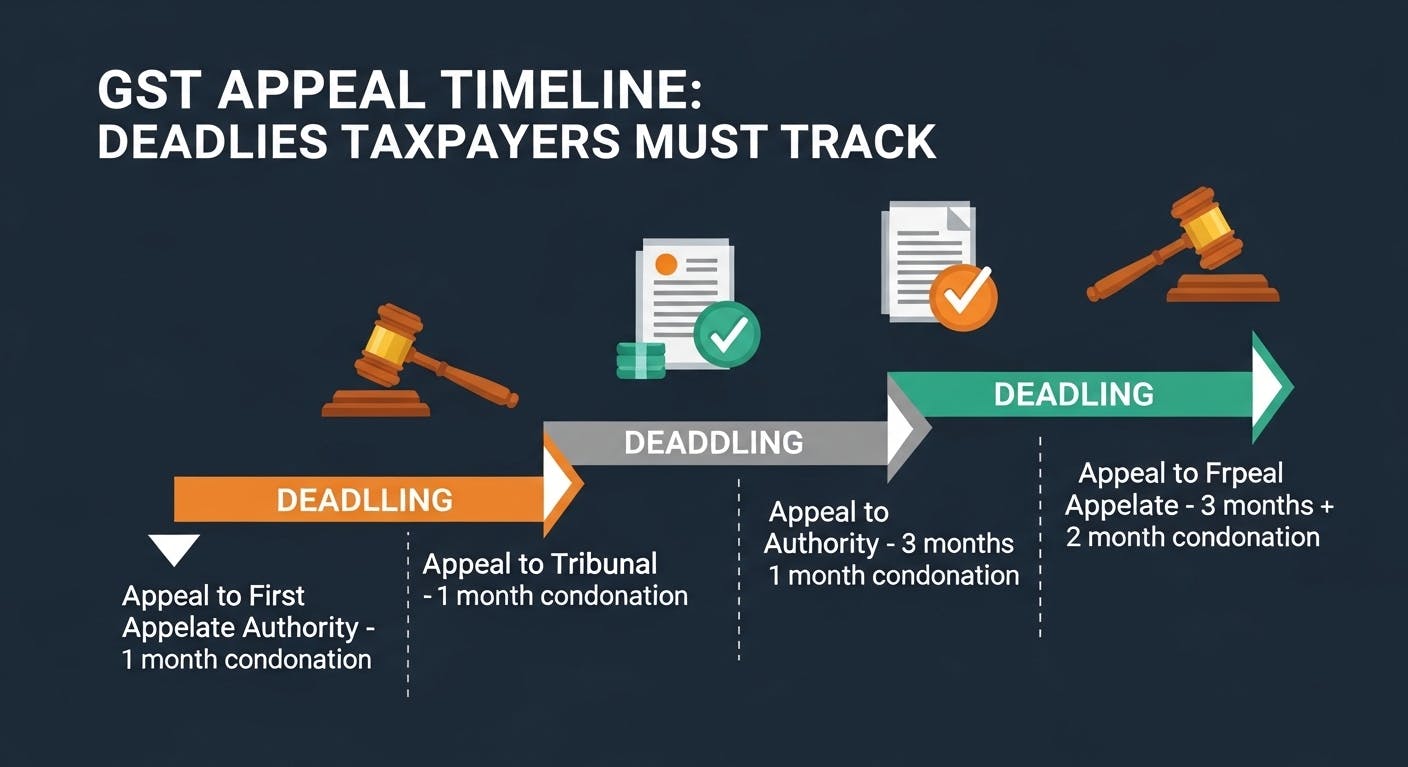

Many taxpayers lose cases not because they are wrong, but because they miss appeal deadlines.

If you receive an adverse GST order, you must file an appeal:

A delay of:

After this, the right to appeal is lost forever.

With GSTAT now becoming functional, appeals must be filed:

This makes it even more important to track GST appeal timelines carefully, especially for old cases, and understand the GSTAT appeal deadlines under Section 112.

Limitation is not just a defence it is a powerful closure tool.

A GST notice can be dropped or quashed if:

Courts have repeatedly held that limitation is a legal right, not a technical excuse.

Many notices issued today suffer from limitation issues, especially those related to:

Taxpayers should always check dates first, not just allegations.

Check:

If time has expired, raise a limitation objection immediately.

If you have:

Act fast. Once the GST appeal timeline ends, the matter cannot be reopened.

If audit proceedings are continuing for very old years:

In most cases, NO.

Limitation can be extended only if:

Administrative delays or internal issues do not justify extension.

Know more: How to handle GST litigation in India - A complete Guide

Recent judgments show a clear trend:

This makes limitation one of the strongest arguments in GST litigation today.

Many businesses confuse GST timelines with income tax timelines.

Key difference:

This is why GST matters must be tracked more carefully.

To protect your position:

Know more: The Impact of GST on Corporate Taxes in India: A Comprehensive Analysis

The GST limitation period can either protect you or harm you depending on how well you understand and use it.

As March 31, 2026 approaches, this is the last chance to:

GST law rewards those who act on time.

Ignoring limitation can cost you even when you are right.

If you are dealing with old GST notices, pending appeals, or long-running audits, now is the right time to review and act before the window closes permanently. Consulting a trusted CA firm in Gurgaon can help you navigate these deadlines effectively.

GST Limitation Period ends March 31! Close notices & appeals under CGST Act Section 73 & 74. Know the time limit for GST demands, avoid penalties.

POEM Tax India: Foreign Subsidiary Resident Triggers. Understand POEM rules in India for foreign companies. Determine tax triggers for a company in India.

Understand withholding tax on cross-border payments in India. This guide covers TDS, DTAA treaty benefits, tax rates, deduction, compliance.