Transfer Pricing (TP) Study Report Applicability In India

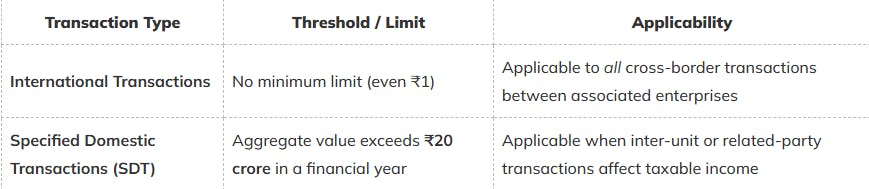

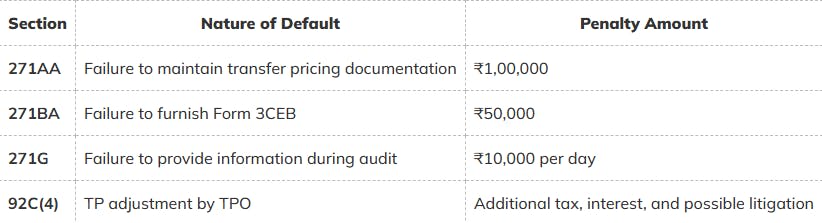

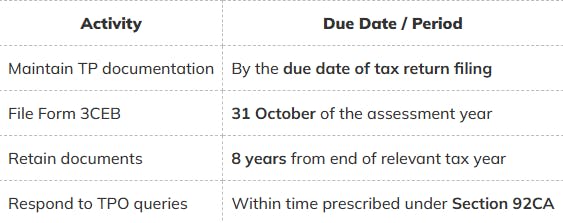

The complete applicability of Transfer Pricing Study Reports in India. Understand when TP documentation is mandatory, thresholds, penalties for non-compliance, and how CA experts can help ensure accurate transfer pricing reporting under Section 92D.