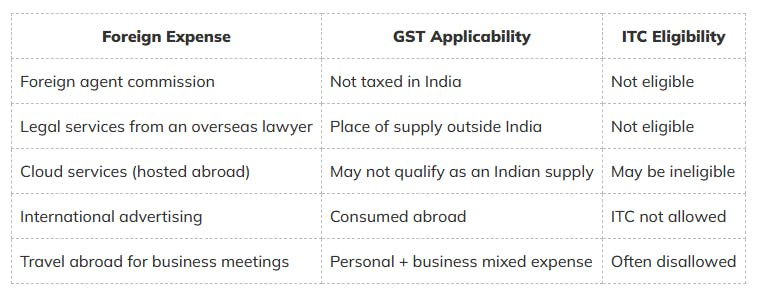

Input Tax Credit (ITC) Issues for Exporters With Foreign Expenses in India

Are you an exporter in India? If yes, then you must be aware of the complex GST laws related to Input Tax Credit (ITC) issues for exporters with foreign expenses. As one of the top chartered accountant firms in Gurgaon, we will simplify the complex laws and regulations. Read more to find out: