Refund of GST on Export of Services: A Complete Guide [2025]

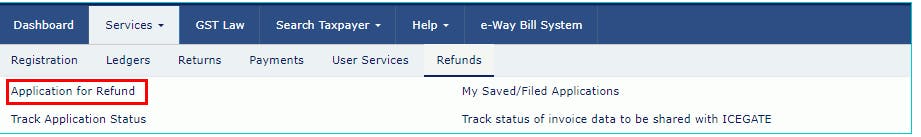

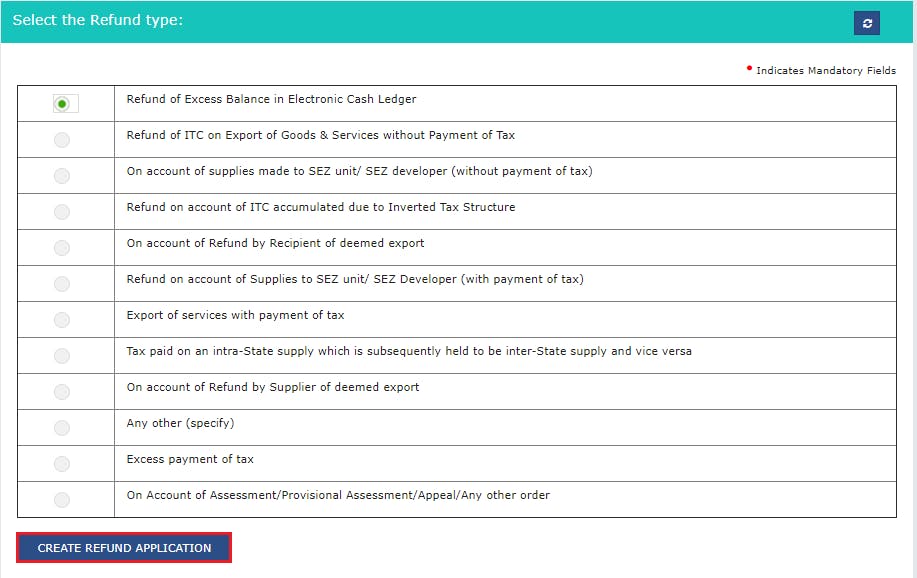

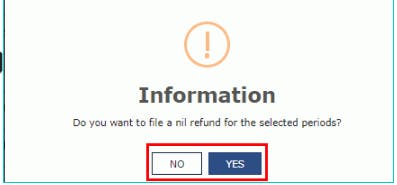

Did you know that you can claim a refund on account of export of services? If you are a business exporting services to other parts of the world, then learning about the refund of GST on export of services can help you recover money from taxes. The top GST consultant in Gurgaon will break down the process in simple terms. Read more here: