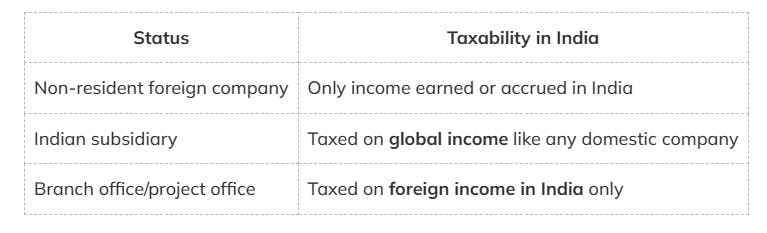

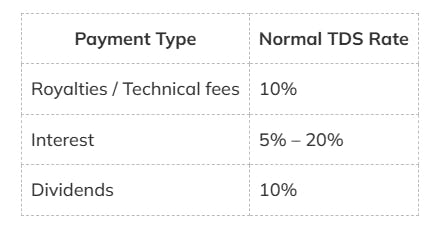

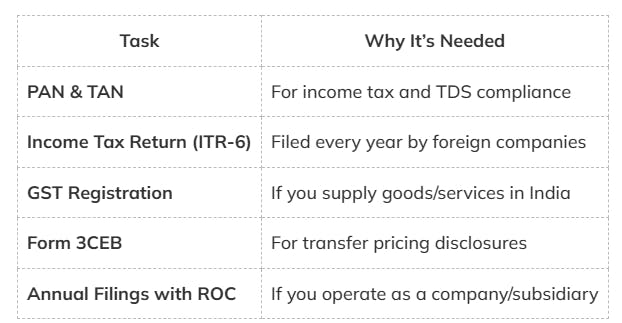

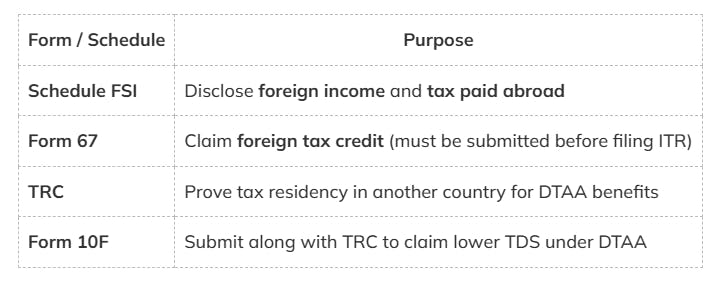

How Foreign Companies Are Taxed in India: A Complete Guide

Planning to start a business in India as a foreign company? Discover how foreign companies are taxed in India in 2025 – from income tax to GST, DTAA, and compliance tips. Get expert insights from DSRV India.