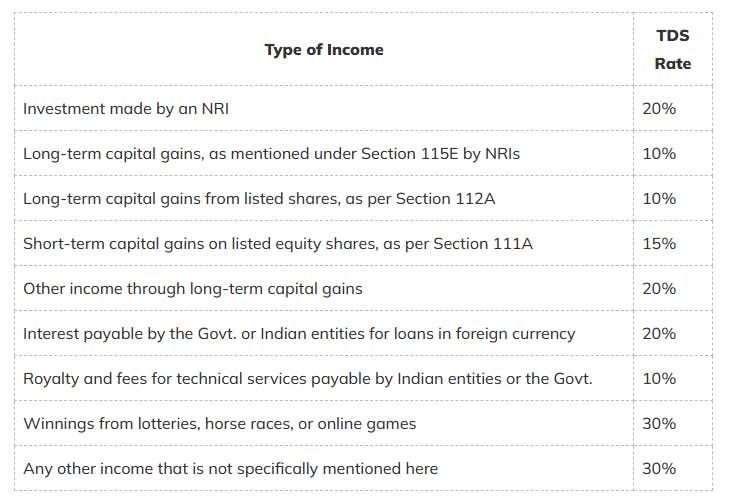

TDS Provisions on Foreign Remittances under Section 195 of Income Tax Act

The Income Tax Department in India has specific provisions for foreign remittances under Section 195. This blog simplifies TDS Provisions on Foreign Remittances under Section 195 so that you can file tax returns accurately, without the hurdle of having to understand complicated jargon. Read more to find out: