Client-Centric Approach

Our client's success is our top priority. We take a personalised approach, understanding your unique needs and providing tailored solutions that drive your business forward.

Our client's success is our top priority. We take a personalised approach, understanding your unique needs and providing tailored solutions that drive your business forward.

We ensure the accuracy and integrity of your financial statements. Trust our experienced auditors to maintain transparency and compliance in financial records.

Our experienced team has a strong track record of delivering exceptional results for businesses across diverse industries, backed by a wealth of knowledge and a history of success.

DSRV India comprises a team of professional income tax consultant in Gurgaon and each one of us is dedicated to providing you with the best tax advice to grow your business.

We specialize in tax planning, compliance, and optimization to maximize tax benefits. Our tax consultant Gurgaon can find innovative solutions that can maximize your tax benefits.

Above all, we place great value on client relationships and strive to create lasting partnerships with our clients by providing them with the highest levels of service and support. Have a question? We’re ready to answer all your queries!

As a trusted CA firm in Gurgaon, we are committed to supporting your growth goals. Know More!

Our vision is to become the best CA firm in Gurgaon that provides excellent tax savings solutions.

We want to reduce the tax-related worries of every business in Gurgaon by providing tailored solutions.

We aim to help our clients with innovative CA services that reduce tax liabilities and increase profits.

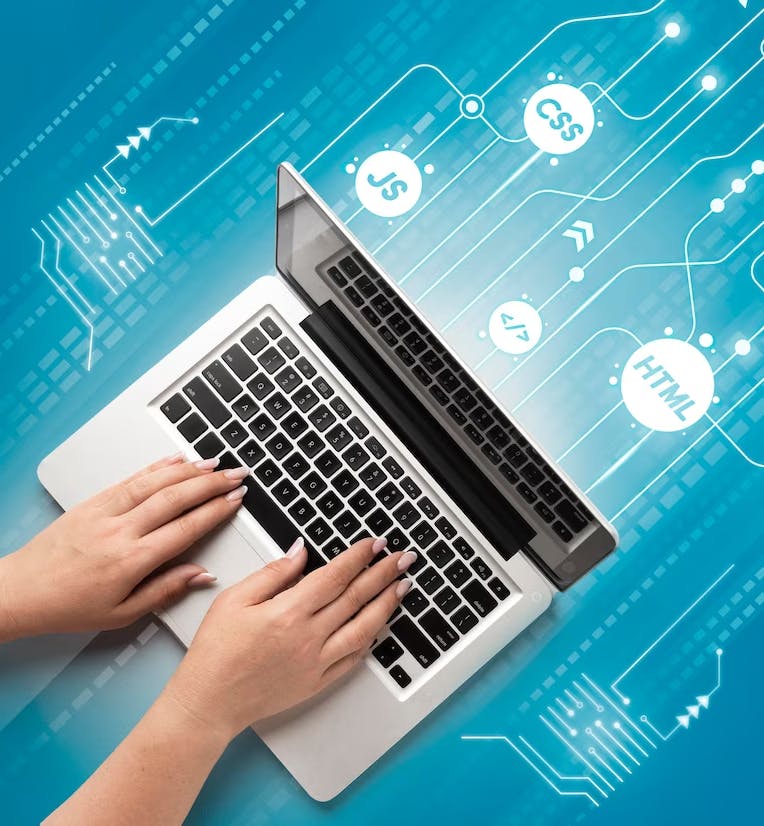

Discover how our customized tax solutions of our CA Firm in Gurugram drive innovation and success in various industries.

Our tax consultants in Gurgaon help businesses & individuals like you with taxes, finances, and audits - all under one roof!

Our experienced chartered accountants in Gurgaon provide strategic advice to ensure that tax implications on overseas transactions are effectively managed.

Using our expertise in tax consultant services in Gurgaon, we create personalized tax strategies that reduce your tax bills while remaining compliant with ever-changing tax rules.

Our comprehensive CA services in Gurgaon include GST registration, which ensures seamless compliance and helps your firm negotiate the complexity of Goods and Services Tax.

Our services help you through the process of name selection to registration, ensuring that your business is incorporated smoothly.

Audit services offered by our CA in Gurgaon give assurance and validation of your financial statements providing credibility and transparency to stakeholders.

Our experts in financial strategy provide business-specific advisory services, helping your business optimize operational efficiency and achieve strategic goals.

Feeling stressed about a tax return? Relax! Our tax consultant firm in Gurgaon has been helping businesses develop and thrive for over 30 years. We handle all those complex tax issues so you can focus on growing your business. We explain everything clearly, find solutions that save you money, and keep you updated on the latest rules.

We're here every step of the way, answering your questions and making sure you feel confident. So get rid of unnecessary stress and let's work together to create a bright, financially secure future for your business.

Feel the difference by learning the top-notch qualities of our income tax consultants in Gurgaon.

Our tax consultants bring a lot of experience in tax consulting to ensure precise, customized solutions for your tax needs.

We prioritize your individual financial goals, developing tax solutions that effortlessly aligns with your objectives.

We build plans that not only optimize your tax position in the present, but also lay the foundation for long-term tax efficiencies.

Our certified tax consultant keeps themselves up-to-date with the latest developments in tax laws and regulations to help you gain the maximum benefits.

We know dealing with tax filing or GST registration can be confusing, but with our expert help, it'll be a breeze.

We’re known as the result-driven chartered accountant firms in Gurgaon for offering the most innovative, cost-effective accounting solutions. Our chartered accountant in Gurgaon analyzes your situation, finds potential deductions you might've missed, and makes sure you pay the least amount possible.

Whether you own a small business or a large corporation, we can deliver the highest level of service and expertise to help you achieve your financial goals.

Discover inspiring success stories from our satisfied and happy clients. See how we've helped turn their financial dreams into reality with our expert guidance.

Explore our success stories and witness remarkable transformations in our clients' financial futures. Experience the power of expert financial guidance!

Get answers to your burning questions about CA services in Gurgaon. Empower your financial decisions with expert insights and guidance. Explore now!

Gurgaon chartered accountant provides expert advice on tax planning and compliance, helping individuals and businesses navigate complex tax laws to minimize liabilities and ensure legal adherence.

Hiring a tax consultant in Gurgaon ensures expert guidance on local tax laws and regulations, helping you optimize tax strategies and minimize liabilities.

To find the best tax advisor in Gurgaon, seek referrals from reliable sources, check their credentials and experience, and consult with them to assess their knowledge in your tax issues.

Hiring a tax consultant depends on factors such as the complexity of your tax situation, the scope of services needed, and the expert's experience. However, you should consult with the tax advisor to know about their pricing structure.

DSRV India is widely regarded as one of the most reliable tax consultants in Gurgaon, with a reputation for excellence in tax planning, compliance, and advisory services for both businesses and individuals.

Yes, DSRV India offer services for both individuals and businesses. We are well-versed in the tax regulations that apply to different organizations and can provide tailored advice accordingly.

Unlock the world of tax responsibilities for non-residents in India: filing returns, exemptions, and the role of Gurgaon's chartered accountant firms. Dive in!

Know ins and outs of taxation for non-residents under the Indian Income Tax Act, including special provisions and expert tax planning services, much more!

Are you a startup in India? Learn about key considerations for GST registration. DSRV India provides expert tax litigation and GST services for startups.