BUDGET BYTE – KNOW ABOUT NEW TAX REGIME VS OLD TAX REGIME?

If you are unaware of the changing tax regime. Then, DSRV India is here to solve your doubts about the new tax regime and old tax regime in this blog.

If you are unaware of the changing tax regime. Then, DSRV India is here to solve your doubts about the new tax regime and old tax regime in this blog.

0-3 Lakh: No Tax

3-6 Lakh: 5%

6-9 Lakh: 10%

9-12 Lakh: 15%

12-15 Lakh: 20%

Above 15 Lakh: 30%

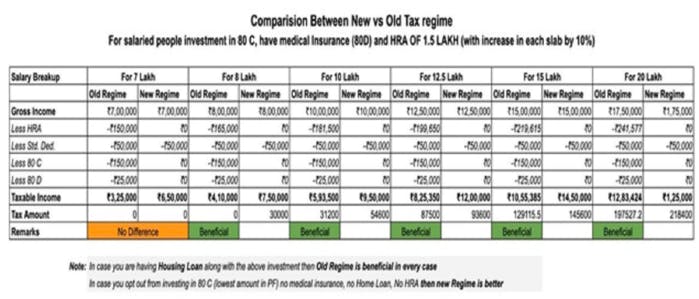

Hence, Government wants to promote new tax regime claimed to be simple tax services with lesser tax rates but without exemptions and deductions. Our analysis shows that if one is claiming deduction of HRA, investments u/s 80C and medical insurance u/s 80D, then in most of these cases old regime will be the obvious choice of an Individual. The default tax regime will be the new tax regime and one has to choose the old tax regime by filling a form unlike presently.

Understand tax penalty proceedings. Learn about assessment under the Income Tax Act, when a penalty can be imposed, and initiation of proceedings.

Understand faceless assessments & appeals under Income Tax Act. Guide to the scheme, taxpayer rights, and handling notices.

GST Limitation Period ends March 31! Close notices & appeals under CGST Act Section 73 & 74. Know the time limit for GST demands, avoid penalties.